Retailers group welcome Illicit Trade report that highlights attractiveness of smuggling to criminals in Ireland

Retailers call for next Programme for Government to seriously commit to tackling the illegal trade of tobacco and fuel.

March 15, 2016As the Black Market continues to grow, what will the new Government do differently to tackle the blight of smuggling?

May 27, 20169 May 2016

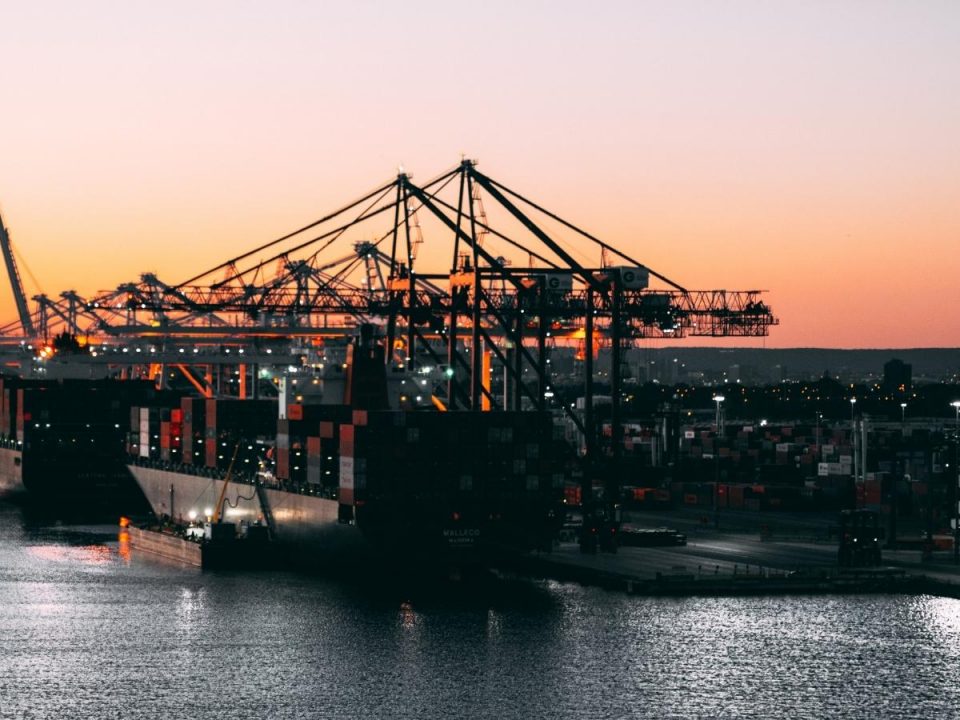

The Illicit Trade 2015-2016 Implications for the Irish economy released today by Grant Thornton highlights that the key driver for the illicit trade of cigarettes and tobacco products is the increasing level of excise tax. Retailers Against Smuggling spokesperson and retailer Benny Gilsenan reacted today: “Increasing excise tax is nothing more than a tax on the poor and small legitimate businesses who’s legal cigarette trade can account for 20-30% of business.” RAS welcomes the recommendations to increase international cooperation with EU and non-EU law enforcement agencies, strengthen controls in Irish ports and airports and promote security preventive measures for all persons engagement in the tobacco supply chain.

In regards to solid fuel smuggling the Report recommends the auditing of fuel suppliers by Revenue, obtaining records of the same based in Northern Ireland and registering all solid fuel traders as is done with petroleum oil suppliers. Benny went on to say “Grant Thorton’s yearly report highlights the impact the Black Market has not only to our economy but to the legitimate businesses who are selling legitimate products.”

One of the recommendations in the Report is to increase the penalty for those caught smuggling cigarettes because the low penalties imposed in Ireland make it an attractive trade for criminals and convictions have decreased between 2010 and 2014 from 97 to 53. “These criminals go largely unpunished and with fines averaging €2,700, this is a lucrative illegal business for criminal. Now we have a new government it is time they tackle the illegal trade that is devastating small businesses across the country.”