Retailers Against Smuggling call for government to increase resources in budget to combat smuggling

Only three scanners available to monitor all the country’s ports

August 2, 2023

New poll: Half of 18-34 year olds willing to purchase illegal tobacco

October 6, 2023Illegal tobacco sales cost the Exchequer €384 million in 2022, Revenue needs more funds to combat smuggling

In its pre-budget submission released today, Retailers Against Smuggling have called for increased resources for Revenue to combat smuggling at a time where 30% of tobacco products consumed in Ireland are either illegal or Non-Irish Duty Paid, costing the Exchequer €384m in 2022.

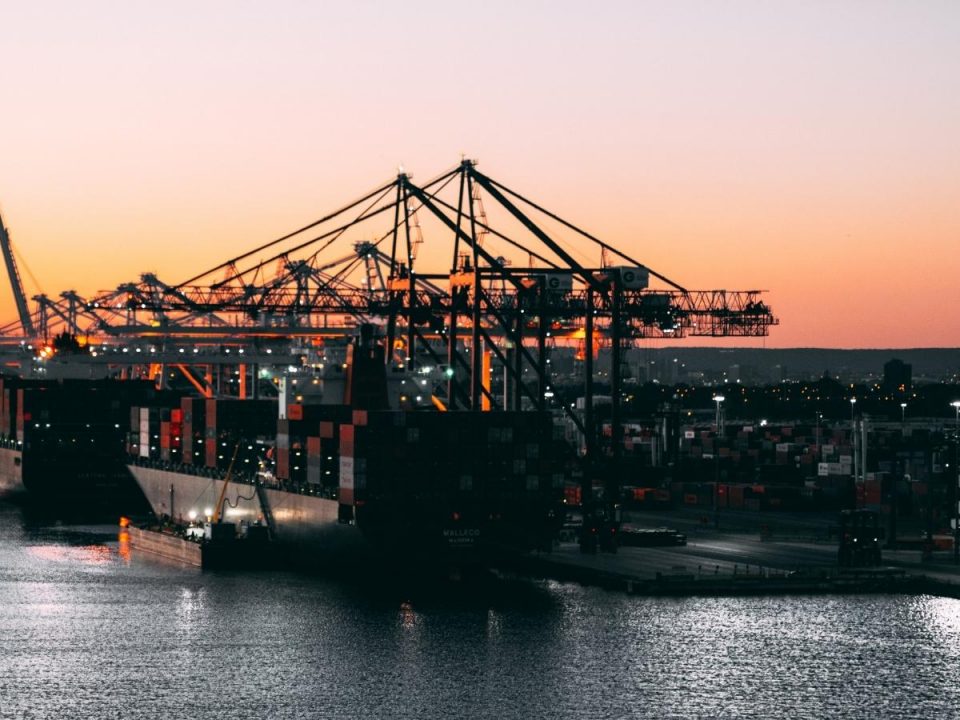

RAS proposes that 30% of funds collected from the new licence fee is ringfenced for initiatives that will meaningfully deal with the growth of smuggling activities in the country. Currently, Revenue has 23 detector dog teams and three mobile x-ray scanners. With more than 1.2 million freight vehicles and trailers passing through the three main Irish ports last year, Revenue faces a mammoth task in detecting counterfeit goods being smuggled into the country and so meaningful resources are desperately needed against this backdrop.

In the space of just one week (25-31 May, 2023) Revenue seized nearly 8 million cigarettes at Dublin Port representing a loss of €5m to the Exchequer; with two further major seizures of 10 million cigarettes on June 9, and €10 million worth of counterfeit cigarettes seized in Dublin on July 4, showing the size of the illegal tobacco market in Ireland.

The magnitude of this issue can be best explained by the outcome of a recent poll by Ireland Thinks which found that 32% of smokers said they were prepared to purchase illegal tobacco. To sum this up, Revenue estimates the amount lost to the Exchequer from illegal cigarettes to be more than €2.1 billion between 2013 and 2022.

17% of all cigarette and roll-your-own packs in Ireland have been found to be illegal, with a further 13% being non-Irish Duty Paid, representing 30% of all tobacco products in the country. Rates of illegal cigarettes in 2022 jumped by 43% compared to the previous year (Source: Revenue Illegal Tobacco Products Research Surveys 2022).

Under the Public Health Bill, the new licensing system will require a retailer who wishes to sell tobacco products or nicotine inhaling products to apply for an annual licence for each outlet with a yet unspecified fee, instead of a once-off fee of €50 in the current registration system. This new system will add further unnecessary administrative burden and cost on retailers.

The border with Northern Ireland is also causing issues for retailers. According to a recent RTE Prime Time Investigates programme from April 2022, 100,000 tonnes of smoky coal smuggled from Northern Ireland (which is not subject to carbon tax) is costing the Exchequer €8.7 million. If this continues, by 2025, a total of €77 million will be lost to the State through carbon tax evasion alone.